About Us.

Founded in 2016, Marathon Venture Partners (“MVP”) is a leading early-stage venture capital firm focusing on digital health.

Marathon Venture Partners focuses intensively on the early-stage of entrepreneurship, creating a forward-looking framework in the three major areas: efficient access, innovative payment, and efficiency improvement of digital health. This approach aids in the transforming and upgrading of China's medical and health system by reducing costs and raising the quality of medical service, which benefits 1.4 billion people.

To date, MVP’s RMB and USD funds have invested in more than 70 companies, including medical devices, mobile healthcare and services, precision diagnosis, and medical insurance companies with inniovative core technologies and innovative business models. The founding team has accumulated over RMB 3 billion in investment management.

MVP partners have a proven track record of excellent performance and sharp industry insight: more than a dozen companies that they have previously invested in have been listed on major stock exchanges or exited via M&A, with many companies emerging as industry leaders. Members of the investment management team are all graduates from prestigious universities, with rich industry experience and a profound understanding of medical investment.

Marathon Venture Partners has received numerous accolades, having been named as Zero2IPO Group's "Top 30 Chinese Medical Investment Institutions”, China Venture Group’s "China's Best Early-stage Venture Capital Institutions," and "Top 30 Best Healthcare Investment Institutions". They have also been recognized as 36Kr’s "Top 50 Most Popular Venture Capital among Entrepreneurs”, "Top 50 Most Popular Venture Capital among LPs", and China FOF’s "Top 30 Early-stage Funds with Best Return". VC Beat also named them a "Top 10 Digital health Investment Institutions". Moreover, members of the investment team have earned titles such as Forbes’ "China's Best Investor", PE Daily’s "TOP100 Investors", and VC Beat’s "Best Medical Investors".

Recognizing that entrepreneurship is not easy, MVP is committed to fostering new opportunities in crises and creating new prospects in the face of changing circumstances with hope. We are inspired by the passion and energy of our entrepreneurial partners and are dedicated to providing long-term support and abundant resources to them through the peaks and valleys of startup life, aiming to change the world through our collaborative action.

Investment Approach.

The healthcare industry in China is facing huge and urgent challenges: an aging population, limited access to quality services, and inefficient distribution channels. As the core driving force of business transformation, digital technology is bound to spawn a new wave of medical innovation opportunities and bring new and ample solutions.

With the drive of innovation in both technologies and business models, China is expected to become the largest market for digital health innovation in the world. There are more and more innovative companies emerging and solving industry challenges with great commercial value.

We believe the three major infrastructures of efficient access, innovative payment, and efficiency improvement will allow for previously unaddressable medical service needs to be met, life-cycle protection to be conducted, and quality services to be accessed efficiently.

On the policy side, new opportunities are emerging from the reform and innovation of China's healthcare plan. For example, the review of new devices and drugs has been accelerated, the practice of doctors is gradually opening up, and distribution channels are being drastically restructured. All these changes will eventually reshape the trillion-scale medical service market, bringing about continuous investment opportunities.

In the past few years, Marathon Venture Capital has invested in several digital heath leading companiess, such as Shukun Technology (Artificial intelligence imaging company), Meditrust Health (Commercial medical insurance company), and Soonsolid Technology (Dental 3D digital service company), and Vedeng Medical (B2B medical equipment trading platform).

Meet Our Team.

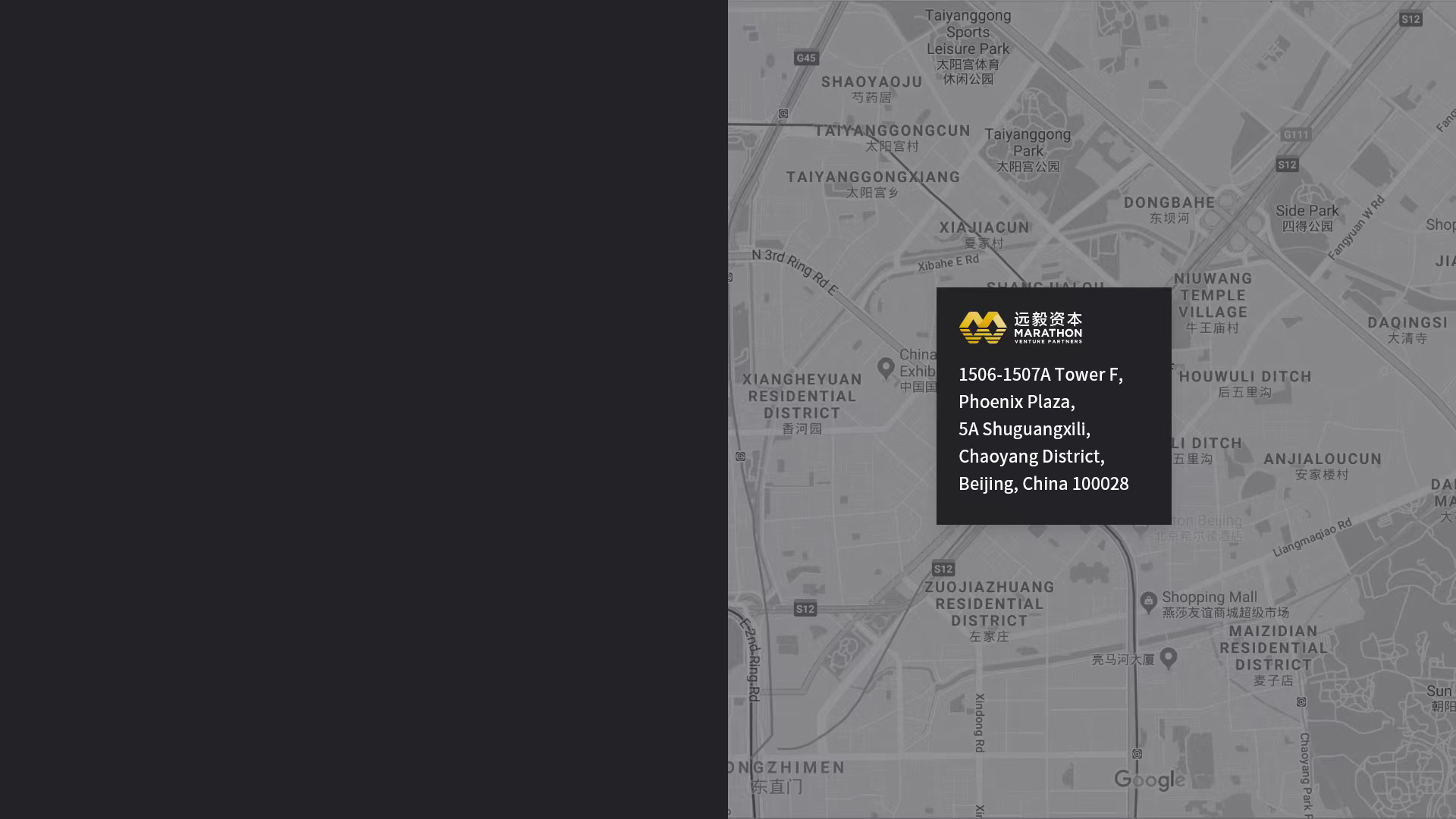

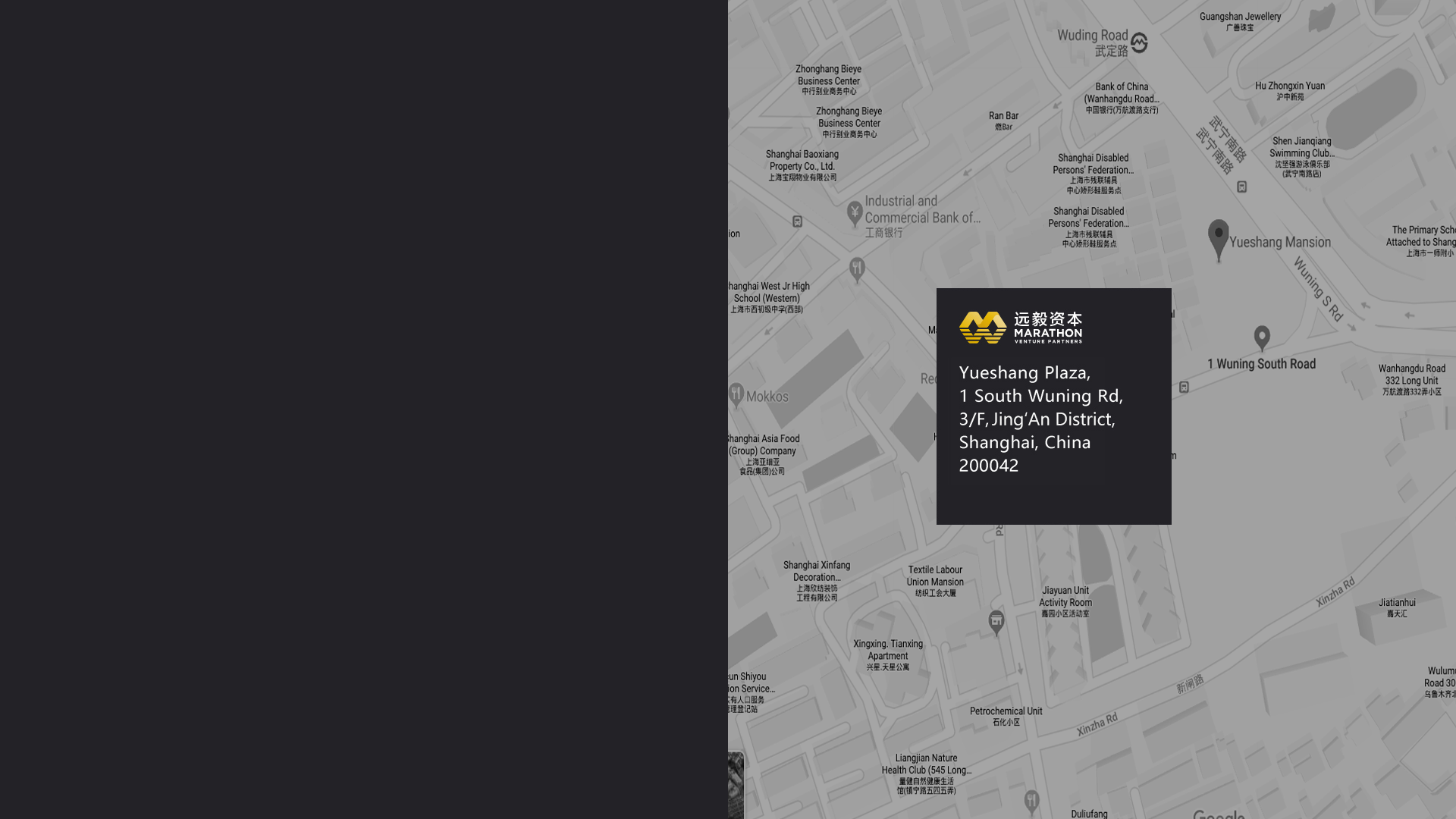

Contact Us.

Address:

京公网安备 11010502051966号

京公网安备 11010502051966号